Customer Acquisition Cost (CAC) isn’t just another metric, it’s the compass that guides your growth strategy and determines whether your business will thrive or struggle to survive.

Understanding and optimizing your CAC can mean the difference between sustainable growth and burning through your runway without meaningful returns. This comprehensive guide will walk you through everything you need to know about CAC, from basic calculations to advanced optimization strategies that can transform your startup’s growth trajectory.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) represents the total amount your company spends to acquire a single new customer. This metric encompasses all marketing and sales expenses divided by the number of customers acquired during a specific period.

Think of CAC as your customer acquisition efficiency meter. It tells you exactly how much investment is required to convert a prospect into a paying customer, helping you make informed decisions about resource allocation and growth strategies.

For startups, CAC is particularly crucial because it directly impacts your ability to scale profitably. A high CAC relative to customer lifetime value can quickly drain resources, while an optimized CAC enables sustainable growth and attracts investors.

Why CAC is Critical for Startup Success

Profitability Assessment

CAC helps determine whether your customer acquisition efforts generate positive returns. By comparing CAC to customer lifetime value, you can assess the long-term profitability of your acquisition strategies.

Resource Allocation

Understanding which channels deliver the lowest CAC allows you to allocate marketing budgets more effectively, maximizing your return on investment.

Investor Attraction

Investors scrutinize CAC metrics when evaluating startup viability. A healthy CAC-to-LTV ratio demonstrates business sustainability and growth potential.

Strategic Planning

CAC insights inform pricing strategies, product development priorities, and expansion plans by revealing the true cost of growth.

Competitive Advantage

Startups with optimized CAC can outmaneuver competitors by acquiring customers more efficiently and investing savings in product development or market expansion.

How to Calculate Customer Acquisition Cost: Step-by-Step Formula

Basic CAC Formula

CAC = (Total Sales and Marketing Costs) ÷ (Number of New Customers Acquired)

Step-by-Step Calculation Process

Step 1: Define Your Time Period Choose a specific timeframe for analysis (monthly, quarterly, or annually). Consistency in timing ensures accurate comparisons and trend analysis.

Step 2: Calculate Total Acquisition Costs Include all expenses related to customer acquisition:

- Marketing Costs:

- Advertising spend (paid search, social media, display)

- Content creation and production

- Marketing software and tools

- Email marketing platforms

- Marketing agency fees

- Sales Costs:

- Sales team salaries and commissions

- Sales software and CRM systems

- Sales training and development

- Lead generation tools

- Sales collateral and materials

- Overhead Costs:

- Portion of rent and utilities

- Equipment and technology

- Administrative support

- Legal and compliance costs

Step 3: Count New Customers Determine the total number of new customers acquired during your chosen period. Ensure you’re counting only new customers, not renewals or upsells.

Step 4: Apply the Formula Divide total costs by new customers acquired.

Practical CAC Calculation Example

SaaS Startup Example:

- Marketing spend: $15,000

- Sales team costs: $25,000

- Tools and software: $3,000

- Overhead allocation: $7,000

- Total costs: $50,000

- New customers acquired: 200

- CAC = $50,000 ÷ 200 = $250 per customer

Types of Costs to Include in Your CAC Calculation

Direct Marketing Costs

- Pay-per-click advertising

- Social media advertising

- Content marketing expenses

- Email marketing tools

- SEO tools and services

- Influencer partnerships

- Event marketing and sponsorships

Sales-Related Expenses

- Sales representative salaries

- Sales commissions and bonuses

- CRM and sales enablement tools

- Sales training programs

- Lead qualification costs

- Demo and presentation materials

Technology and Infrastructure

- Marketing automation platforms

- Analytics and tracking tools

- Customer support software

- Website development and maintenance

- Landing page optimization tools

Personnel Costs

- Marketing team salaries

- Sales team compensation

- Customer success team allocation

- Freelancer and contractor fees

- Benefits and overhead for relevant staff

Understanding CAC vs. LTV: The Golden Ratio

What is Customer Lifetime Value (LTV)?

Customer Lifetime Value represents the total revenue a customer generates throughout their relationship with your company. For startups, understanding the LTV:CAC ratio is crucial for sustainable growth.

LTV Calculation Formula

LTV = (Average Purchase Value × Purchase Frequency × Customer Lifespan)

The Ideal LTV:CAC Ratio

3:1 Ratio Target The golden standard for most businesses is an LTV:CAC ratio of 3:1, meaning customers should generate three times more value than the cost to acquire them.

Ratio Interpretations:

- 1:1 or lower: Unsustainable – you’re spending as much or more than customers are worth

- 2:1: Potentially viable but leaves little room for growth or unexpected costs

- 3:1: Healthy ratio indicating sustainable growth potential

- 5:1 or higher: May indicate under-investment in growth opportunities

Payback Period Considerations

Aim to recover your CAC within 12 months of customer acquisition. This ensures healthy cash flow and reduces risk from customer churn.

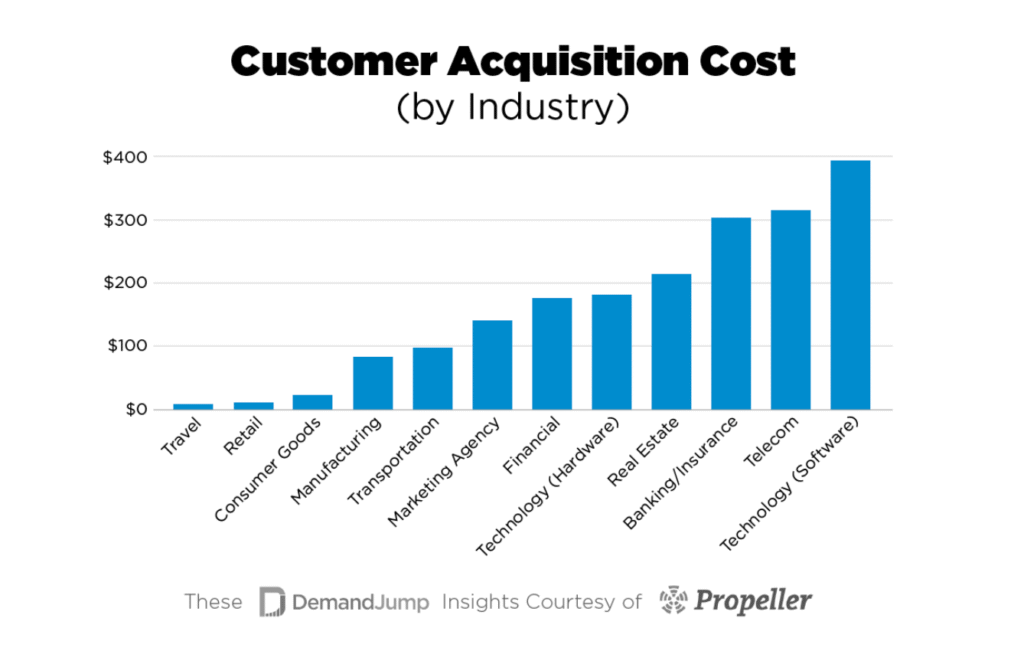

Industry Benchmarks: Where Does Your Startup Stand?

Understanding industry-specific CAC benchmarks helps contextualize your performance and set realistic targets.

CAC Benchmarks by Industry

Technology Sector:

- SaaS (B2B): $205 – $415

- SaaS (B2C): $87 – $205

- Mobile Apps: $20 – $200

- E-commerce: $45 – $200

Service Industries:

- Consulting: $300 – $1,000

- Digital Agencies: $150 – $500

- Financial Services: $175 – $900

- Healthcare: $200 – $800

Consumer Goods:

- Retail: $10 – $50

- Subscription Boxes: $30 – $150

- Food & Beverage: $15 – $75

Factors Influencing Industry Variations

Purchase Value Higher-value products typically justify higher acquisition costs due to increased customer lifetime value.

Sales Cycle Length Industries with longer sales cycles often have higher CAC due to extended nurturing requirements.

Competition Level Highly competitive markets drive up advertising costs and customer acquisition expenses.

Customer Behavior Industries with high customer loyalty can sustain higher CAC due to extended customer lifespans.

10 Proven Strategies to Reduce Your CAC

1. Optimize Your Conversion Funnel

Focus on Conversion Rate Optimization (CRO):

- A/B test landing pages, headlines, and call-to-action buttons

- Streamline the signup or purchase process

- Optimize for mobile users

- Implement exit-intent popups

- Use social proof and testimonials strategically

Impact: Improving conversion rates by just 2% can reduce CAC by 20-30% without increasing traffic costs.

2. Implement Referral Programs

Create Incentive-Based Referral Systems:

- Offer rewards for both referrer and referee

- Make sharing easy with simple tools and processes

- Track and optimize referral performance

- Leverage satisfied customers as brand advocates

Benefits: Referral customers often have $0 acquisition cost and higher lifetime values due to pre-existing trust.

3. Invest in Content Marketing and SEO

Build Long-Term Organic Acquisition:

- Create valuable, educational content targeting your audience

- Optimize for relevant keywords and search intent

- Build domain authority through consistent publishing

- Develop comprehensive resource libraries

Advantage: While requiring upfront investment, SEO has minimal ongoing acquisition costs.

4. Leverage Marketing Automation

Nurture Leads Efficiently:

- Implement drip email campaigns

- Score leads based on engagement and behavior

- Personalize messaging based on user segments

- Automate follow-up sequences for higher conversion rates

Result: Automation can reduce sales cycle length and improve conversion rates while minimizing manual effort.

5. Focus on Customer Retention

Increase Lifetime Value:

- Develop comprehensive onboarding programs

- Provide exceptional customer support

- Create loyalty programs and incentives

- Regularly engage customers with valuable content

Impact: Increasing retention by 5% can increase profits by 25-95% and improve LTV:CAC ratios significantly.

6. Optimize Channel Performance

Analyze and Prioritize High-Performing Channels:

- Track CAC by acquisition channel

- Identify your most cost-effective channels

- Reallocate budget from high-CAC to low-CAC channels

- Test new channels systematically

Strategy: Focus 80% of budget on channels with proven low CAC and strong conversion rates.

7. Improve Sales Process Efficiency

Streamline Your Sales Funnel:

- Qualify leads more effectively

- Reduce sales cycle length through better processes

- Train sales teams on objection handling

- Implement sales enablement tools

Outcome: Faster, more efficient sales processes reduce the time and resources needed per acquisition.

8. Personalize Customer Experiences

Tailor Messaging and Offers:

- Segment audiences based on behavior and demographics

- Create personalized landing pages

- Use dynamic content in emails and ads

- Implement recommendation engines

Benefits: Personalization can improve conversion rates by 10-30% and reduce acquisition costs.

9. Build Strategic Partnerships

Leverage Complementary Businesses:

- Partner with businesses serving similar audiences

- Create co-marketing opportunities

- Develop integration partnerships

- Participate in industry collaborations

Advantage: Partnership-driven customers often have lower acquisition costs and higher trust levels.

10. Continuously Test and Optimize

Implement Data-Driven Improvements:

- Run regular A/B tests on all acquisition channels

- Monitor and analyze CAC trends consistently

- Test new messaging, offers, and targeting strategies

- Use attribution modeling to understand customer journeys

Importance: Continuous optimization ensures CAC improvements compound over time.

Advanced CAC Optimization Techniques for Growing Startups

Cohort Analysis for CAC Optimization

Segment CAC by Customer Cohorts:

- Analyze CAC trends over time

- Identify seasonal patterns

- Compare performance across customer segments

- Track cohort-specific lifetime values

Application: Use cohort insights to adjust acquisition strategies and budget allocation for maximum efficiency.

Multi-Touch Attribution Modeling

Understand the Complete Customer Journey:

- Implement tracking across all touchpoints

- Assign value to each interaction in the conversion path

- Optimize budget allocation based on channel contribution

- Identify hidden high-performing channels

Benefits: Multi-touch attribution provides more accurate CAC calculations and optimization opportunities.

Predictive CAC Modeling

Forecast Future Acquisition Costs:

- Use historical data to predict CAC trends

- Model the impact of market changes on acquisition costs

- Plan budget allocation based on predicted performance

- Identify potential optimization opportunities early

Value: Predictive modeling enables proactive CAC management and strategic planning.

Common CAC Calculation Mistakes to Avoid

1. Incomplete Cost Inclusion

Failing to include all relevant costs such as overhead, software subscriptions, and personnel time can lead to significantly understated CAC.

2. Wrong Time Attribution

Not aligning the time period for costs with customer acquisition can skew results, especially for channels with longer sales cycles.

3. Mixing New and Existing Customers

Including upsells, renewals, or reactivated customers in new customer counts inflates success metrics artificially.

4. Ignoring Channel-Specific CAC

Calculating only blended CAC without channel breakdowns prevents optimization of individual acquisition strategies.

5. Static Analysis

Failing to track CAC trends over time misses important patterns and optimization opportunities.

Tools and Software for CAC Tracking

Customer Relationship Management (CRM)

- HubSpot: Free CRM with built-in CAC calculation tools

- Salesforce: Advanced analytics and custom reporting capabilities

- Pipedrive: Simple CAC tracking with visual sales pipeline

Analytics and Attribution Platforms

- Google Analytics 4: Free attribution modeling and conversion tracking

- Mixpanel: Advanced cohort analysis and user behavior tracking

- Amplitude: Product analytics with detailed user journey insights

Financial Tracking Tools

- QuickBooks: Expense tracking and financial reporting

- FreshBooks: Time tracking and cost allocation features

- Xero: Real-time financial data and reporting

Marketing Attribution Solutions

- Attribution: Multi-touch attribution modeling

- Bizible (Adobe): B2B marketing attribution platform

- Ruler Analytics: Call tracking and offline attribution

Building a CAC-Focused Growth Strategy

1. Set Clear CAC Targets

Establish specific, measurable goals for CAC reduction based on industry benchmarks and business objectives.

2. Create Cross-Functional Alignment

Ensure marketing, sales, and customer success teams understand CAC importance and work collaboratively toward optimization.

3. Implement Regular Reporting

Develop weekly or monthly CAC reports that track progress and identify optimization opportunities.

4. Establish Testing Frameworks

Create systematic approaches to testing new acquisition strategies and measuring their impact on CAC.

5. Plan for Scale

Consider how CAC might change as you grow and plan strategies to maintain efficiency at larger volumes.

The Future of CAC Optimization

As the startup ecosystem becomes increasingly competitive, CAC optimization will become even more critical for success. Emerging trends include:

AI-Powered Optimization

Machine learning algorithms will increasingly automate CAC optimization through predictive modeling and real-time budget allocation.

Privacy-First Attribution

With increasing privacy regulations, startups will need new methods for tracking and attributing customer acquisition costs accurately.

Customer Experience Integration

CAC optimization will become more integrated with overall customer experience strategies, recognizing that acquisition and retention are interconnected.

Channel Diversification

Successful startups will develop more diverse acquisition channel portfolios to reduce dependency and improve overall CAC efficiency.

Conclusion: Your Path to CAC Excellence

Customer Acquisition Cost optimization is not a one-time exercise but an ongoing commitment to efficient growth. By understanding the true cost of acquiring customers, implementing systematic optimization strategies, and continuously monitoring performance, your startup can achieve sustainable, profitable growth.

Remember that the lowest CAC isn’t always the goal—the objective is finding the optimal balance between acquisition cost and customer quality that maximizes long-term business value. Start with accurate measurement, implement the strategies outlined in this guide, and maintain a relentless focus on optimization.

The startups that master CAC optimization today will be the market leaders of tomorrow. Begin your optimization journey now, and watch as improved acquisition efficiency transforms your growth trajectory and business success.

Ready to optimize your startup’s customer acquisition strategy? At SevenSEO, we help growing companies develop data-driven acquisition strategies that reduce CAC while increasing customer quality. Contact us to discover how we can accelerate your growth through smarter customer acquisition.