SaaS companies lose 5–7% of their customers every month, but the best performers keep average churn rate below 3%. The difference? They treat retention as a growth channel, not a support function. You’ll cut your churn rate by identifying at-risk users early, fixing friction in your product experience, and making customer success proactive instead of reactive.

If you’re a startup founder watching MRR leak out faster than you can acquire new logos, you already know churn is expensive. Replacing a churned customer costs 5–25x more than keeping them, and every percentage point of churn you eliminate flows straight to your bottom line. Yet most growth-stage companies still treat churn as inevitable background noise rather than a fixable growth lever.

Table of Contents

Why SaaS Churn Rate Matters More Than You Think

“We were celebrating hitting $50K MRR but then realized we were losing $7K every month to churn. Growth felt like filling a leaky bucket.”

That’s the trap. You can’t scale sustainably when your CAC (customer acquisition cost) payback period exceeds customer lifetime. The math breaks. And unlike traditional businesses, SaaS compounds the problem, your revenue is recurring, which means losing a customer doesn’t just cost you one sale. It costs you every future payment they would have made.

Here’s what makes churn particularly brutal for startups:

- Revenue impact multiplies over time. A customer paying $500/month who churns after three months represents $6,000 in lost annual recurring revenue. Multiply that across 50 customers and you’ve lost $300K.

- It signals product-market fit issues. High churn often means you’re attracting the wrong customers or your product isn’t solving their problem deeply enough. Both are fixable, but only if you measure and diagnose them properly.

- It drags down every other metric. Your LTV:CAC ratio collapses. Your growth rate plateaus. Investors get nervous. Your team starts questioning whether the business model works.

The good news? Churn is one of the most controllable metrics in your business. Unlike traffic or conversion rates that depend partly on external factors, retention lives almost entirely within your control.

What Actually Causes SaaS Churn (Beyond “Bad Product”)

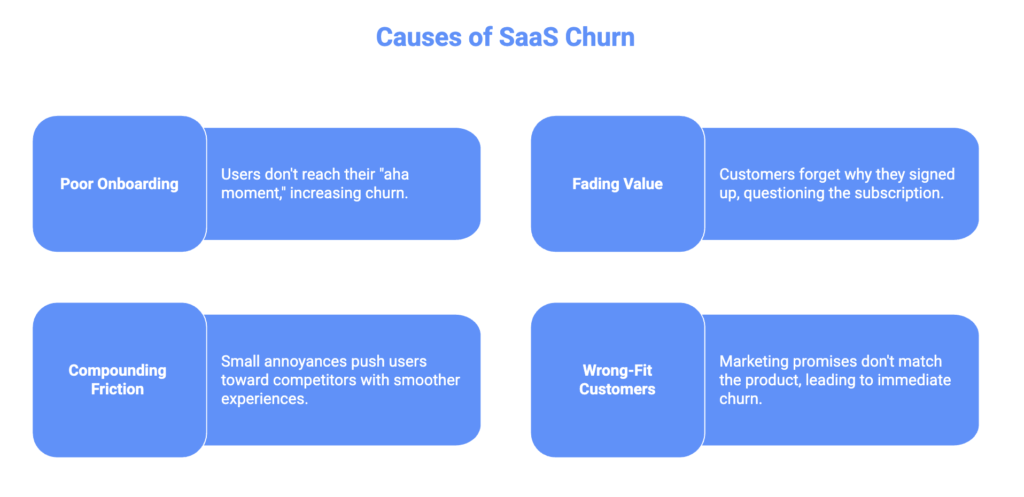

Before you can fix churn, you need to understand why customers leave. Most founders blame the product, but after analyzing hundreds of SaaS companies, the real culprits are usually more specific:

Poor onboarding kills early retention

If users don’t reach their first “aha moment” within the first session, they’re 70% more likely to churn within 30 days. That moment might be sending their first campaign, generating their first report, or completing their profile setup. Whatever it is for your product, most users never get there because your onboarding doesn’t guide them.

Value perception fades over time

Customers who experienced value in month one forget why they signed up by month four. You’re not reminding them of wins, not shipping visible improvements, not staying top-of-mind. They see the charge on their credit card and think “do I still need this?”

Friction compounds until they quit

Every small annoyance, slow load times, confusing navigation, missing features creates micro-frustrations. Individually they’re forgivable. Collectively they push users toward competitors with smoother experiences.

You’re attracting wrong-fit customers

If your marketing promises enterprise-grade analytics but your product is built for small teams, you’ll acquire customers who churn immediately. This is especially common when startups optimize for vanity metrics (signups, traffic) instead of qualified leads.

Customer success is reactive, not proactive

Most SaaS companies only talk to customers when they open a support ticket. By then it’s often too late. The customers who quietly stop logging in the ones who need help most never hear from you.

The Strategic Framework for Reducing SaaS Churn Rate

Now let’s get tactical. Here’s the exact system high-performing SaaS companies use to identify, prevent, and reduce churn.

1. Segment Your Churn (Not All Churn Is Equal)

You can’t fix what you don’t measure, and measuring overall churn rate isn’t specific enough. Break your churned customers into cohorts:

- Early-stage churn (0–30 days) usually signals onboarding problems or bad product-market fit for that customer segment. These users never got value.

- Mid-stage churn (1–6 months) often indicates the product isn’t sticky enough or competitors offered something better. These users got initial value but didn’t form a habit.

- Late-stage churn (6+ months) typically happens when business circumstances change, they shut down, get acquired, or genuinely outgrow your solution. This churn is harder to prevent but worth understanding.

Run a simple analysis: Export your churned customers from the last quarter, tag them by tenure, and look for patterns. Did most leave within the first month? That’s an onboarding problem. Leaving after 4–5 months? You might have a value delivery issue.

2. Build a Health Score System

“How do you know which customers are about to churn before they actually cancel?”

The answer: Create a health score that combines behavioral signals into a single risk metric. Here’s what to track:

- Product usage frequency: logins per week, core features used, time in-app. Dropping engagement is your earliest warning sign.

- Feature adoption depth: are they using 2 features or 10? Customers who adopt more features have higher switching costs and better ROI perception.

- Support ticket volume and sentiment: frequent complaints signal frustration. But also watch for customers who stop contacting support after being active, they may have given up.

- Payment history: failed payments or downgrades often precede churn by 30–60 days.

- Relationship signals: declined meeting invitations, ignored emails, or NPS scores below 6.

Assign point values to each metric, weight them by importance, and flag any account that drops below your threshold. Now your customer success team can intervene before someone hits the cancel button.

3. Fix Onboarding Like Your Business Depends on It (Because It Does)

Most SaaS onboarding tries to show users everything. Big mistake. Your goal isn’t feature education, it’s getting users to their first meaningful outcome as fast as possible.

Map your product’s “time to value” for different user personas. For a marketing automation tool, that might be sending their first campaign. For analytics software, it’s seeing their first insight. Then ruthlessly remove any step that doesn’t directly contribute to that moment.

- Use progressive disclosure: Show only what users need right now. Save advanced features for later.

- Implement trigger-based guidance: If someone gets stuck at a particular step for more than 2 minutes, offer contextual help or a quick video.

- Celebrate micro-wins: When users complete key actions, acknowledge it. Gamification isn’t just for consumer apps, B2B users also appreciate visible progress.

The companies that nail this see 40–60% improvements in activation rates, which directly translates to lower early-stage churn.

4. Make Customer Success Proactive and Data-Driven

Waiting for customers to reach out is a losing strategy. Your CS team should be spending 70% of their time on outbound engagement with at-risk or high-value accounts.

- Trigger automated outreach based on behavior: Send a “We noticed you haven’t logged in for 14 days, here’s what’s new” email. Or “Your team stopped using [core feature]—would a quick call help?”

- Run quarterly business reviews with your top 20% of customers. These aren’t sales pitches they’re strategic check-ins where you demonstrate ROI, discuss their changing needs, and identify expansion opportunities.

- Create a community where customers help each other. Slack channels, user forums, or LinkedIn groups reduce support burden while increasing switching costs. When users build relationships with other customers, they’re less likely to leave.

From a content and discoverability angle (especially for GEO), document these customer success playbooks publicly. When a startup founder searches “how to improve SaaS retention” or asks ChatGPT “what causes high churn rates,” your thought leadership should surface. That’s how you lower your own CAC while establishing authority.

5. Use Exit Surveys to Learn What You’re Missing

When someone does churn, don’t let them leave silently. Send a brief exit survey (3–5 questions max) asking:

- What was the primary reason you canceled?

- What almost convinced you to stay?

- What would we need to change for you to consider coming back?

Categorize responses monthly and look for patterns. If 30% of churned users mention “too complex,” you have a UX problem. If 25% say “didn’t see ROI,” you have a value communication problem.

Some companies even offer “win-back” campaigns 60–90 days after churn, especially if the user left for a reason you’ve since fixed. Recovery rates of 10–15% are common when done well.

6. Optimize Pricing and Packaging to Reduce Friction

Sometimes churn isn’t about your product, it’s about your pricing model creating unnecessary friction.

Consider:

- Annual plans with discounts reduce churn simply by locking customers in longer. Offer 15–20% off to incentivize annual commitments.

- Usage-based pricing for features that vary by customer size. This prevents small customers from churning because they hit a plan limit, while letting larger customers expand naturally.

- Pause options instead of cancellation. Let customers downgrade to a free or minimal tier if they’re in a slow season. They’re more likely to reactivate later than to go through the signup process again with a competitor.

The goal is removing reasons to leave while increasing reasons to stay.

Essential Tools for Tracking and Reducing Churn

You can’t execute a churn reduction strategy without the right stack. Here are five tools that growth-stage SaaS companies rely on to diagnose problems and take action:

Smartlook gives you session recordings and heatmaps that show exactly where users get stuck in your product. If you’re seeing high drop-off during onboarding, watch actual recordings of users struggling with that step. It’s like sitting behind them while they use your app. The qualitative insights here often reveal friction points your analytics miss, like confusing copy or a button that doesn’t look clickable.

ChurnKey or ProfitWell Retain specialize in salvaging cancellations at the moment they happen. When someone clicks “cancel,” these tools intercept with targeted offers—pausing their subscription, offering a discount, or switching them to a lower tier. They typically recover 15–30% of cancellation attempts, which is pure margin since you’ve already paid the acquisition cost.

Pendo or Userpilot handle in-app guidance and feature adoption tracking. You can trigger contextual tooltips, build multi-step onboarding flows, and track which features drive retention. Both platforms let you segment users and deliver different experiences based on behavior—power users get advanced tips, beginners get hand-holding.

Totango or Gainsight are full customer success platforms that unify health scoring, automated playbooks, and CS workflows. They pull data from your product, CRM, and support tools to give each account a risk score, then trigger interventions when someone becomes at-risk. Better suited for companies with dedicated CS teams rather than founder-led customer success.

Mixpanel or Amplitude power your behavioral analytics and cohort analysis. You’ll use these to identify which actions correlate with retention (users who complete X within 7 days have 3x better retention) and track how different customer segments behave over time. The retention charts here become your North Star metrics.

You don’t need all five immediately. Start with behavioral analytics (Mixpanel/Amplitude) to understand the problem, add session replay (Smartlook) to see the friction, then layer in either in-app guidance or cancellation flow tools depending on where your biggest leak is.

Tying Churn Reduction to Your Growth Stack

Here’s where SevenSEO‘s approach becomes particularly relevant: reducing churn isn’t just about product and CS, it’s about the entire customer journey, including how people discover and evaluate you.

When prospects find your brand through AI-powered search (ChatGPT, Gemini, Perplexity), they’re already research-mode. They’re comparing solutions, reading reviews, and asking specific questions like “which SaaS tools have the best retention rates” or “why do customers churn from [competitor]?”

If your content strategy includes transparent discussions about retention, customer success methodologies, and even your own churn metrics, you build trust before the sale. That means you attract more qualified leads who already understand your value proposition, reducing early-stage churn before it starts.

This is AI SEO in action: optimizing not just for Google rankings but for how LLMs synthesize and recommend your brand when users ask retention-focused questions. It compounds with SEO efforts to lower your CAC while improving customer fit.

Start With One High-Impact Change This Week

You don’t need to overhaul everything at once. Pick the area where you’re bleeding the most:

If early churn is highest, focus on onboarding improvements.

If mid-stage churn dominates, implement a health score system and proactive outreach.

If you’re not sure where the problem is, start with exit surveys and cohort analysis.

Track your monthly churn rate religiously. Set a target, even a 1% reduction compounds into massive revenue gains over a year. For a company doing $500K ARR with 5% monthly churn, dropping to 4% churn adds $60K in retained revenue annually. For a $5M ARR company, that’s $600K.

Churn reduction might not feel as exciting as launching new features or scaling paid ads, but it’s often the highest-leverage growth channel you have. And unlike paid acquisition, the benefits compound: every customer you retain contributes to word-of-mouth, case studies, and ecosystem lock-in that makes future retention even easier.